psm-tyumen.ru

Prices

How Much Is Instant Hot Water Heater

RHEEM EGSP20 Point-of-Use Gallon Instant Electric Commercial Water HeaterOur Point-of-Use commercial electric line is designed to provide instant. As far as initial cost is concerned, a good quality whole house electric tankless water heater generally cost about $, whereas a typical gas tankless. SmartHome Indoor GPM Natural Gas Tankless Water Heater, SHA Series $ Save $) Now: $ Free Shipping Fast Shipping Options. Rheem® gas tankless water heaters and accessories are in stock and ready to ship! Shop Now. Shop Tankless Water Heaters by Key Features. Tankless and miniature tank electric water heating is a zero emission solution that when installed at the point-of-use, consistently delivers the fastest time-. The best price now in is around $, that's $75 per year for on-demand hot water. If you're unwilling to replace your heater every four years don't buy. sys Electric Shower Water Heater Instant Hot Water Faucet ° Rotating Fast Heating Water Price & Deals. Price. $12 – $+. Deals & Discounts. All Discounts. Tankless water heaters, also known as demand-type or instantaneous water heaters, provide hot water only as it is needed. A tankless water heater, also known as a demand-type or instantaneous water heater, provides a household with hot water as needed. It doesn't require a tank to. RHEEM EGSP20 Point-of-Use Gallon Instant Electric Commercial Water HeaterOur Point-of-Use commercial electric line is designed to provide instant. As far as initial cost is concerned, a good quality whole house electric tankless water heater generally cost about $, whereas a typical gas tankless. SmartHome Indoor GPM Natural Gas Tankless Water Heater, SHA Series $ Save $) Now: $ Free Shipping Fast Shipping Options. Rheem® gas tankless water heaters and accessories are in stock and ready to ship! Shop Now. Shop Tankless Water Heaters by Key Features. Tankless and miniature tank electric water heating is a zero emission solution that when installed at the point-of-use, consistently delivers the fastest time-. The best price now in is around $, that's $75 per year for on-demand hot water. If you're unwilling to replace your heater every four years don't buy. sys Electric Shower Water Heater Instant Hot Water Faucet ° Rotating Fast Heating Water Price & Deals. Price. $12 – $+. Deals & Discounts. All Discounts. Tankless water heaters, also known as demand-type or instantaneous water heaters, provide hot water only as it is needed. A tankless water heater, also known as a demand-type or instantaneous water heater, provides a household with hot water as needed. It doesn't require a tank to.

Get Instant Hot Water Heater price options and installation cost ranges. Free, online Instant Hot Water Heater cost guide breaks down fair prices in. Tankless Water Heaters ; Camplux 16L GPM (CSA) Indoor Tankless Water Heater With Thimble -Grey · $ · $ · $ · $ ; Camplux 12L Indoor. Transitioning to a tankless water heater installation entails initial expenses. The initial purchase price varies by type, ranging from $ for electric units. Tankless Water Heaters ; Camplux 12L High Capacity propane Indoor Tankless Water Heater · $ · $ ; Camplux 5L Portable Tankless Water Heater (CSA. I've recently replaced my water heater. It costed me about $ I asked the plumber how much it would cost to get the tankless heater. A tankless water heater heats up water as you need it, and it brings hot water to your appliances quickly—and never runs out. Tankless water heaters and their compatibility with solar. When a tankless water heater is installed, it can be connected with a solar energy system. The. That's why when it's time to equip your new home, or replace your old water heater it's important to consider cost, efficiency, and longevity of your new water. Electric tankless water heaters produce a continuous supply of hot water as needed reducing energy usage. These electric-powered heaters. List of Instantaneous hot water heaters with prices. Buy directly from "Same Day Hot Water" to save! Buy an Instantaneous hot water heater online now. On-Demand Gas Tankless Hot Water Heaters for homes, Portable Propane Tankless Water Heaters for camping & outdoor showers, & Electric Mini Tank Water. Water Heater Style. Regular. (9). Short. (4) ; Type (1). Tank. (). Tankless. () ; Power Source. Gas. (). Electric. (). Instahot Instant Water Heater() ; current price $ ; current price $ ; current price $ ; current price $ ; With everyday great prices, shop in-store or online today Electric Water Heater,Domestic Instant Water Heater Electric Tankless Water Heater Electric Hot. New Electric Tankless Water Heater GPM 11KW @V RODWIL AMERICA · CAMPLUX 1 lb Propane Portable Water Heater Table Top Instant Hot Camping Shower · Camplux. AO Smith electric tankless water heaters are compact, easy to install, and offer continuous hot water when sized appropriately for your home. How many people live in your home? Tankless water heaters supply almost limitless hot water**, but the pressure may not keep up with demand if everyone needs it. Noritz is the premiere tankless water heater manufacturer for gas tankless water heaters and propane tankless water heaters. 18L 5GPM Tankless LPG Liquid Propane Gas Hot Water Heater On-Demand Water Boiler · $ Was: $was - US $ ; New Electric Tankless Water Heater The Onsen Portable Tankless Water Heater turns cold water into instant hot water so you can enjoy a hot shower on all your outdoor adventures.

Financial Guide For Young Adults

Five money management tips for young adults · 1. Track your income · 2. Create budget categories · 3. Start spending and saving intentionally · 4. Use credit. Money and Youth serves as a “Guide to Financial Literacy” for youth ages 14 and up – but also serves as a primer for adults, especially parents and teachers. This is a book for young adults in their own households who have limited income, are students or recent graduates or recently married, and need to get their. The 5 most important financial lessons for teens · 1. Know where the money comes from · 2. Understand the benefits of saving · 3. Track expenses to stay on budget. That mindset shift can help you feel better about setting aside money to invest when you're young.” A streamlined way to set yourself up for the future? Set. Good budgeting is a skill everyone should have. For young adults, budgeting will look essentially the same as it does for parents: Money experts suggest using. Financial Planning for Young Adults (FPYA), developed in partnership with the CFP Board, is designed to provide an introduction to basic financial planning. Five money management tips for young adults · 1. Track your income · 2. Create budget categories · 3. Start spending and saving intentionally · 4. Use credit cards. Much of the material in this guide comes from our Financial Basics course, which concentrates on some of the basic knowledge young adults need to know -. Five money management tips for young adults · 1. Track your income · 2. Create budget categories · 3. Start spending and saving intentionally · 4. Use credit. Money and Youth serves as a “Guide to Financial Literacy” for youth ages 14 and up – but also serves as a primer for adults, especially parents and teachers. This is a book for young adults in their own households who have limited income, are students or recent graduates or recently married, and need to get their. The 5 most important financial lessons for teens · 1. Know where the money comes from · 2. Understand the benefits of saving · 3. Track expenses to stay on budget. That mindset shift can help you feel better about setting aside money to invest when you're young.” A streamlined way to set yourself up for the future? Set. Good budgeting is a skill everyone should have. For young adults, budgeting will look essentially the same as it does for parents: Money experts suggest using. Financial Planning for Young Adults (FPYA), developed in partnership with the CFP Board, is designed to provide an introduction to basic financial planning. Five money management tips for young adults · 1. Track your income · 2. Create budget categories · 3. Start spending and saving intentionally · 4. Use credit cards. Much of the material in this guide comes from our Financial Basics course, which concentrates on some of the basic knowledge young adults need to know -.

Developing good financial habits at a young age will help you to maintain Examine the chart What do People Earn Chart. Given your current education and. The 5 most important financial lessons for teens · 1. Know where the money comes from · 2. Understand the benefits of saving · 3. Track expenses to stay on budget. A Financial Guide. For Youth. Page 2. First edition COPYRIGHT Young adults, this booklet aims to educate and inform you about making wise. Money and Teens: Savvy Money Skills · Manage Your Money Like a Grownup: The best money advice for · Money for Teens: A Guide for Life · The Money Book for Teens. The FPYA course is organized across eight separate modules within a 4-week window. Topics covered include financial goal setting, saving and investing. 50 Personal Finance Tips That Will Change the Way You Think About Money · 1. Create a Financial Calendar · 2. Check Your Interest Rate · 3. Track Your Net Worth · 4. Making financial life goals It's easier to save money if you have goals. Write down your goals and what it will take to get there. One goal might be paying. The average credit card debt of teenagers rose percent from to The financial world has become increasingly complex and dangerous over the last. Establish an emergency fund. Every adult should have months of their salary saved in an easy-to-access account in case of an emergency expense. Start an. "Unfortunately, the economic downturn has caused many young adults to fear investing in the stock market," says Rachel Cruze, a professional personal finance. What good tips can you tell them about how to manage their credit card? Answers: See the “Answers Section” in the back of this workbook. Page Savings and bank accounts · My savings rule to live by · Moving your checking account checklist · Consumer guide to checking account denials · Consumer guide to. 8 financial tips for young adults · 1. Learn self-control · 2. Control your financial future · 3. Know where your money goes · 4. Start an emergency fund · 5. Start. First, has the young adult set up financial systems to organize their money and classify their budget line items? Everyone needs – at minimum – savings. The most common investors in SSCs are children or young adults. SSCs are not that common or popular, as investors usually choose to invest in. Regularly putting money aside for your future life goals is a good habit to pick up. Even if you can only afford to save a small amount each payday, you'll. Much of the material in this guide comes from our Financial Basics course, which concentrates on some of the basic knowledge young adults need to know -. Financial Tips for Young Adults · How Young Adults Can Build Their Credit Profiles · Smart Tips for Finding a Financial Advisor · Get to Know Financial Advisors. Financial literacy is the cornerstone of a secure, independent life, yet it's often overlooked in traditional schooling. But here's the kicker – financial. It's helpful to understand your living expenses and what payments you must make each month. Then take stock of the other places where you're spending your money.

What Is Real Estate Doing Right Now

/top-6-reasons-to-be-a-real-estate-agent-2867442-v5-5c12b4f0c9e77c0001f6e015.png)

Homes in Houston have sold for % more than they did a year ago. Summary: The median home sold price in Houston was $, in August , up % from last. Furthermore, the median percentage of the original list price received by sellers has dropped in both areas, indicating that buyers now have greater negotiating. Obviously, it's a supply and demand issue. Supply has to outpace demand for prices to lower. Right now the market is basically in a freeze. More in Real Estate ; California's Dual Crises Are on a Collision Course · By. Jim Carlton. | Photographs by Alex Welsh for WSJ · August 31, ; The Alleged. Record low mortgage rates and a shortage of homes for sale were the primary drivers of this phenomenon. At the same time, temporary shortages in lumber and. The median sales price decreased slightly since the previous month, hitting $, Housing Report. View the data provided by Realtors. Home prices in Ohio were up % year-over-year in July. At the same time, the number of homes sold rose % and the number of homes for sale rose %. "Many folks pause their home shopping activities or pause their sales listing to make the most of other summer activities and vacations. It's no surprise that. 89% of sellers were assisted by a real estate agent when selling their home. Recent sellers typically sold their homes for % of the listing price, and 32%. Homes in Houston have sold for % more than they did a year ago. Summary: The median home sold price in Houston was $, in August , up % from last. Furthermore, the median percentage of the original list price received by sellers has dropped in both areas, indicating that buyers now have greater negotiating. Obviously, it's a supply and demand issue. Supply has to outpace demand for prices to lower. Right now the market is basically in a freeze. More in Real Estate ; California's Dual Crises Are on a Collision Course · By. Jim Carlton. | Photographs by Alex Welsh for WSJ · August 31, ; The Alleged. Record low mortgage rates and a shortage of homes for sale were the primary drivers of this phenomenon. At the same time, temporary shortages in lumber and. The median sales price decreased slightly since the previous month, hitting $, Housing Report. View the data provided by Realtors. Home prices in Ohio were up % year-over-year in July. At the same time, the number of homes sold rose % and the number of homes for sale rose %. "Many folks pause their home shopping activities or pause their sales listing to make the most of other summer activities and vacations. It's no surprise that. 89% of sellers were assisted by a real estate agent when selling their home. Recent sellers typically sold their homes for % of the listing price, and 32%.

Housing industry news, home building and construction, and housing market coverage.

Read our monthly housing market reports to get the most up-to-date statistics and to hear our perspective on what the latest buying and selling trends mean for. The pandemic turbocharged Metro Victoria's housing market, driving up prices at a remarkable pace and causing aspiring homeowners to be pushed further away from. Residential property dominated the market with a revenue share of % in The growth is majorly driven by the millennials as they are more inclined. The rate today is above 7%.Because there are more purchasers than residences for sale, there is a strong likelihood that well-kept and reasonably priced homes. In July , existing-home sales improved, breaking a streak of four consecutive monthly declines. Three out of four major U.S. regions registered sales. Heat Map: The Hottest Real Estate Markets in Q3 Remember the heady real estate price jumps over 50% in a single year that some markets saw in the. The median sales price decreased slightly since the previous month, hitting $, Housing Report. View the data provided by Realtors. The small increase in sales is an improvement for this year's sluggish housing market but are still lower than usual. 1 min read. Go to article · Target, Macy's. Home prices have remained strong despite high interest rates. This continues today, yet we see the Fed ready to change directions and begin lowering interest. Today, Houston homes sell for a median price of $, in an average of 68 days. This is a % lower price & 13 day increase compared to last year. In August. The average home value in United States is $, up % over the past year. Learn more about the United States housing market and real estate trends. Homes in Charlotte have sold for % more than they did a year ago. Summary: The median home sold price in Charlotte was $, in August , up % from. The listing prices of homes in the following locations are on the rise. Common reasons for this include growing demand for homes, a decrease in active listings. “Interest rates are still holding steady in the mid-upper % range. The current market conditions offer more options for buyers along with new potential. Housing activity for both new and existing homes decreased considerably in June. Growth in active listings resulted in downward pressure on home prices. Our housing inventory in September of is now back to a nearly balanced level of months as sellers are beginning to list their homes once again, which. The Real Estate market in the United States is projected to grow by % () resulting in a market volume of US$tn in Record low mortgage rates and a shortage of homes for sale were the primary drivers of this phenomenon. At the same time, temporary shortages in lumber and. Latest research · Featured. Posted in Featured Articles on Aug 19, The Hottest Zip Codes of · Posted in Housing Finance on Aug 29, Mortgage Rates.

What Is Td Bank Savings Account Interest Rate

You can earn a higher-than-average APY with a TD Bank savings account. But TD Bank only offers the highest interest rates on accounts with high balances. I was looking at this TD everyday savings account and the rate is % on the daily closing balance. Does that mean the annual rate is % (% x days. % annual percentage yield (APY) is only available to customers who maintain at least $, on deposit in their TD Signature Savings account AND link an. What types of Savings Accounts do you offer? Are my TD Canada Trust accounts insured? What are the interest rates on your personal bank accounts? Named Coverdell Education Savings, the account is tax-advantaged and can be used for educational purposes. The interest rate varies from % for a month. Users will earn % on their balances, but only if they're maintained at $10, or more. Otherwise, there's no interest earned on the balance at all. Pros &. Personal bank accounts and registered products interest rates ; TD Every Day Savings Account · $0 to $ % ; TD High Interest Savings Account · $0 to. TD Bank Savings Account Rates ; OTHER TIERS: % → $0 - $10k | % → $10k - $25k | % → $25k - $50k | % → $50k - $k. TD Bank's savings account rates range from % to % APY, primarily depending on your account balance. TD Bank has no minimum opening deposit requirement. You can earn a higher-than-average APY with a TD Bank savings account. But TD Bank only offers the highest interest rates on accounts with high balances. I was looking at this TD everyday savings account and the rate is % on the daily closing balance. Does that mean the annual rate is % (% x days. % annual percentage yield (APY) is only available to customers who maintain at least $, on deposit in their TD Signature Savings account AND link an. What types of Savings Accounts do you offer? Are my TD Canada Trust accounts insured? What are the interest rates on your personal bank accounts? Named Coverdell Education Savings, the account is tax-advantaged and can be used for educational purposes. The interest rate varies from % for a month. Users will earn % on their balances, but only if they're maintained at $10, or more. Otherwise, there's no interest earned on the balance at all. Pros &. Personal bank accounts and registered products interest rates ; TD Every Day Savings Account · $0 to $ % ; TD High Interest Savings Account · $0 to. TD Bank Savings Account Rates ; OTHER TIERS: % → $0 - $10k | % → $10k - $25k | % → $25k - $50k | % → $50k - $k. TD Bank's savings account rates range from % to % APY, primarily depending on your account balance. TD Bank has no minimum opening deposit requirement.

TD Signature Savings Relationship Rate: Rates are based off of amount on deposit (tiered interest rates) and whether you qualify for a relationship rate. $1, x 12% Annual rate of interest () x 1 year = $ in interest per year or $10 a month. Compound interest. Definition: Unlike simple interest, which is. -TD Preference Savings: Tiered interest rates, APY rate bump wen you link an eligible TD account, free ATM use when using non-TD ATMs, and. $1, x 12% Annual rate of interest () x 1 year = $ in interest per year or $10 a month. Compound interest. Definition: Unlike simple interest, which is. TD Bank savings account interest rates ; %, $$9, ; %, $10,$24, ; %, $25,$49, ; %, $50,$99, ; %, $, A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. With a high 4% interest rate on every dollar in the account (one of the highest rates in Canada), you can make sure your money is working as hard as you are. The TD Bank Simple Savings account has no monthly maintenance fee for 12 Aggregate balances over $25 million are subject to negotiated interest rates. Featured savings accounts ; Balance up to $9,, % ; Balance $10, to $24,, % ; Balance $25, to $99,, % ; Balance $, to. to maximize earnings through tiered interest. We've created this easy to At TD Bank, all of our statement savings accounts also include convenient. Browse TD Bank personal savings account info, get interest rate information, then compare benefits to find the right one for you. High interest rate. Earn interest, calculated daily when your account balance is $5, or more. · No Transaction Fee Transaction fees waived with minimum. Or $ Earn a relationship rate when you link an eligible TD account,3 and get account perks at no cost. As your balance grows, so does your interest rate—. TD Bank CD rates ; TD Choice Promotional CD, 3 years, % APY, $ ; TD Choice Promotional CD, 5 years, % APY, $ TD Bank offers Simple Savings and Signature Savings accounts. Interest rates are tiered according to the account's balance. There is a $3 charge for each. With a TD Savings Account, you can save for whatever is on your savings to-do list with a $0 monthly fee. Get started. Savings Accounts. A savings. TD Canada Trust Interest Rates ; GIC, up to: %, Jun, ; Savings Accounts, up to: %, Jun, ; Loans, from: %, Jun, ; Home Loans, from: %. CD rates at TD Bank range from % to % APY, depending on the term and relationship. The rate you unlock varies based on the type of CD you choose, the. High interest rates for checking and savings accounts · Variety of savings, checking, loans and investment options · Existing customers can take % off loan. Saving more is easy with an online savings account. Sign up for a TD ePremium Savings Account to get a higher interest rate and free online transfers.

Pros And Cons Of Mutual Funds

ETFs often generate fewer capital gains for investors than mutual funds. This is partly because so many of them are passively managed and don't change their. Pros and cons of mutual funds · Diversification. Since mutual funds involve the investment in various stocks and bonds, they offer investors the important. The pros of investing in mutual funds include diversification, professional management, and lower costs. The cons include lack of control over. Mutual funds have benefits for individual investors, including professional management, diversification, regular statements, and low investment minimums. Cons · Potential for loss: Mutual funds are not FDIC insured and may lose principal and fluctuate in value. · Cost: A mutual fund may incur sales charges either. The advantages of investing in a mutual fund are many. Mutual funds are offered by SEC-registered investment companies that are heavily regulated. The manager's. Mutual funds give you an efficient way to diversify your portfolio, without having to select individual stocks or bonds. · They cover most major asset classes. Mutual Funds and ETFs can be super friends, but you must understand the pros and cons of each and how they impact your unique financial situation. Pros and cons of mutual funds. · Diversified portfolio · Low minimum investment requirement · Professionally managed · Liquidity: Shares can be redeemed on any. ETFs often generate fewer capital gains for investors than mutual funds. This is partly because so many of them are passively managed and don't change their. Pros and cons of mutual funds · Diversification. Since mutual funds involve the investment in various stocks and bonds, they offer investors the important. The pros of investing in mutual funds include diversification, professional management, and lower costs. The cons include lack of control over. Mutual funds have benefits for individual investors, including professional management, diversification, regular statements, and low investment minimums. Cons · Potential for loss: Mutual funds are not FDIC insured and may lose principal and fluctuate in value. · Cost: A mutual fund may incur sales charges either. The advantages of investing in a mutual fund are many. Mutual funds are offered by SEC-registered investment companies that are heavily regulated. The manager's. Mutual funds give you an efficient way to diversify your portfolio, without having to select individual stocks or bonds. · They cover most major asset classes. Mutual Funds and ETFs can be super friends, but you must understand the pros and cons of each and how they impact your unique financial situation. Pros and cons of mutual funds. · Diversified portfolio · Low minimum investment requirement · Professionally managed · Liquidity: Shares can be redeemed on any.

For nearly a century, traditional mutual funds have offered many advantages over building a portfolio one security at a time. Mutual funds provide investors. For nearly a century, traditional mutual funds have offered many advantages over building a portfolio one security at a time. Mutual funds provide investors. A mutual fund is a type of investment that pools money from several investors to create a diversified portfolio. Some of the advantages of mutual funds include advanced portfolio management, dividend reinvestment, risk reduction, convenience, and fair pricing. Because a mutual fund buys and sells large amounts of securities at a time, its transaction costs are lower than what an individual would pay for securities. Mutual funds give you an efficient way to diversify your portfolio, without having to select individual stocks or bonds. They cover most major asset classes and. Mutual funds offer investors the opportunity to group their money together and buy stocks, bonds and other investments “mutually” to invest in a common. What are the pros and cons of investing in mutual funds versus exchange-traded funds? · Sometimes lower expense ratios, sometimes not · Price. The cost for a single investor to buy stocks or bonds through a mutual fund is much lower than investing individually so as to create a diversified portfolio. Pros and cons of money market funds Money market funds are meant to be: However, depending on what's important to you, you'll need to keep these points in. What are the Pros and Cons of Investing in Mutual Funds in a Minor's Name? · Transfer of control at maturity. The control over the investment is transferred to. A mutual fund, on the other hand, combines many different assets—including individual stocks—into one grouping. They tend to be less volatile and risky than. ETFs offer two advantages over mutual funds: they cost less, and they can be more tax efficient. An additional benefit is the trading flexibility ETFs offer. The pros of investing in mutual funds include diversification, professional management, and lower costs. The cons include lack of control over. Mutual funds offer diversification across multiple investments, reducing the risk of putting all your money into one stock or bond. Mutual funds often come with. Fees and expenses: Mutual funds charge a variety of fees, such as management fees and transaction fees. · Lack of control: · Market risk: · Possible. Disadvantages of Mutual Funds · Management Fees. Mutual fund companies have to pay salaries and marketing expenses and they always get paid FIRST before the. Taxes. If you are purchasing mutual funds in your RRSPs, then this isn't an issue. But if you are holding mutual funds in a non-registered account, you have to. These funds are managed by professional fund managers who make investment decisions on behalf of the investors. But like any investment, mutual. Generally speaking ETFs are like mutual funds but trade like they're a stock. Mutual funds trade at the close of the stock market day. Typically ETFs are.

What Credit Card Is Best For A First Time

You have a current balance on a card that you want to pay down. · You have a large purchase to make and need extra time to pay it off. · Earning rewards isn't. Your credit limit is secured by a refundable security deposit, and you get all the great benefits of our Platinum Rewards Mastercard. Your on-time payments are. Citi® Secured Mastercard® · Discover it® Secured Credit Card · Capital One QuicksilverOne Cash Rewards Credit Card. Key takeaways · Try to keep your balance below 30 percent of your available credit limit · Paying on time and more than the minimum can pay off · Learn how to spot. Key takeaways · Try to keep your balance below 30 percent of your available credit limit · Paying on time and more than the minimum can pay off · Learn how to spot. TD Bank has several great credit card choices. Their cards offer online access to your account, and you can apply for any of them psm-tyumen.ru's even a secured. The Secured Mastercard from Capital One is a good first credit card to build credit as it comes with no annual fees or foreign transaction fees. The starting. Good-Excellent Credit. Earn a $ REI gift card after your first purchase outside of REI within 60 days of account opening. Only co-op members can apply. If you're new to using credit altogether, there are credit cards called starter cards, that are designed specifically for those just starting out and applying. You have a current balance on a card that you want to pay down. · You have a large purchase to make and need extra time to pay it off. · Earning rewards isn't. Your credit limit is secured by a refundable security deposit, and you get all the great benefits of our Platinum Rewards Mastercard. Your on-time payments are. Citi® Secured Mastercard® · Discover it® Secured Credit Card · Capital One QuicksilverOne Cash Rewards Credit Card. Key takeaways · Try to keep your balance below 30 percent of your available credit limit · Paying on time and more than the minimum can pay off · Learn how to spot. Key takeaways · Try to keep your balance below 30 percent of your available credit limit · Paying on time and more than the minimum can pay off · Learn how to spot. TD Bank has several great credit card choices. Their cards offer online access to your account, and you can apply for any of them psm-tyumen.ru's even a secured. The Secured Mastercard from Capital One is a good first credit card to build credit as it comes with no annual fees or foreign transaction fees. The starting. Good-Excellent Credit. Earn a $ REI gift card after your first purchase outside of REI within 60 days of account opening. Only co-op members can apply. If you're new to using credit altogether, there are credit cards called starter cards, that are designed specifically for those just starting out and applying.

18 partner offers ; Capital One QuicksilverOne Cash Rewards Credit Card · N/A* · %-5% (cash back) · % (Variable) · $39 ; Credit One Bank Wander American. Credit Cards for No Credit · Capital One Platinum Secured Credit Card · Destiny Mastercard® – $ Credit Limit · Fortiva® Mastercard® Credit Card · PREMIER. The Marriott Bonvoy Boundless® Credit Card card is one of the better hotel cards on the market thanks to its generous signup bonus and annual free night. Apply for a credit card that works for you · Introducing our best credit cards and rewards yet · Cash Rewards Credit Card · Rewards Credit Card · Secured Cash Back. "Secured" credit cards are often the best choice for anyone trying to establish credit for the first time. A secured card means that a security deposit is. Apply for a credit card that works for you · Introducing our best credit cards and rewards yet · Cash Rewards Credit Card · Rewards Credit Card · Secured Cash Back. Some beginner cards may come with rewards like cash back on purchases. For example, QuicksilverOne from Capital One is designed for users with fair credit. The Marriott Bonvoy Boundless® Credit Card card is one of the better hotel cards on the market thanks to its generous signup bonus and annual free night. Your credit limit is secured by a refundable security deposit, and you get all the great benefits of our Platinum Rewards Mastercard. Your on-time payments are. Your first and very best choice is Capital One. Go to their website, click on Credit Cards, then look for a link on the page for their pre-. For the bank, this deposit acts as collateral in case you don't pay your bills each month. Some of the best secured cards include the Capital One Platinum. Secured cards are ideal first-time credit cards because they're typically easier to get approved for. This particular card has no annual fee but requires users. How best to use your credit card · Do make the minimum monthly repayments. Better still, pay off as much as you can afford to, to avoid paying unnecessary. Best for a limited credit history: Capital One QuicksilverOne Cash Rewards Credit Card. Here's why: Capital One says this card is for people with fair credit. Best credit cards with no annual fee in September · + Show Summary · Wells Fargo Active Cash® Card · Capital One SavorOne Cash Rewards Credit Card. Here's a rundown on how credit cards work, the application process and tips for choosing your first credit card. Finding the right credit card boils down to what's most suitable to your financial capacities, lifestyle, and personal preferences. For individuals with no credit history who may have a difficult time qualifying for other options, the OpenSky Credit Card is a great starter card. Unlike many. As you start down the road on your credit card journey, it's ok if you don't know everything right away. Below is a list of questions a first-time applicant.

Outliving A Reverse Mortgage

▫ Higher cost: pay interest and fees on entire loan amount. ▫ No credit line growth feature.*. ▫ Higher risk for younger borrowers of outliving their loan funds. ▫ Higher risk for younger borrowers of outliving their loan funds. *See How can a reverse mortgage affect the people living with me? (continued). You can not outlive a reverse mortgage. The borrowers can live in the home as long as they live without any penalty. Outliving your reverse mortgage — If you don't plan ahead, you could spend all your reverse mortgage loan proceeds before you pass away. Is a Reverse. Generally speaking, a reverse mortgage loan cannot be outlived and will not become due, as long as at least one homeowner lives in the home as their primary. We find that 17–27 percent of actual and rejected borrowers would have qualified for a Home Equity Conversion Mortgage (HECM) reverse mortgage, or nine to How Reverse Mortgages Work: A reverse mortgage allows homeowners to access cash while still living in their homes. As long as they meet. A: Historically there have been many but most are defunct. Aside from HECMs, the only other reverse mortgages offered in the US today are the “jumbos”, which. reverse mortgages provide income for life,”. “consumers can never lose their homes,” or “borrowers can never outlive their reverse mortgage,” but doesn't. ▫ Higher cost: pay interest and fees on entire loan amount. ▫ No credit line growth feature.*. ▫ Higher risk for younger borrowers of outliving their loan funds. ▫ Higher risk for younger borrowers of outliving their loan funds. *See How can a reverse mortgage affect the people living with me? (continued). You can not outlive a reverse mortgage. The borrowers can live in the home as long as they live without any penalty. Outliving your reverse mortgage — If you don't plan ahead, you could spend all your reverse mortgage loan proceeds before you pass away. Is a Reverse. Generally speaking, a reverse mortgage loan cannot be outlived and will not become due, as long as at least one homeowner lives in the home as their primary. We find that 17–27 percent of actual and rejected borrowers would have qualified for a Home Equity Conversion Mortgage (HECM) reverse mortgage, or nine to How Reverse Mortgages Work: A reverse mortgage allows homeowners to access cash while still living in their homes. As long as they meet. A: Historically there have been many but most are defunct. Aside from HECMs, the only other reverse mortgages offered in the US today are the “jumbos”, which. reverse mortgages provide income for life,”. “consumers can never lose their homes,” or “borrowers can never outlive their reverse mortgage,” but doesn't.

For many seniors, a HECM Reverse Mortgage can provide balance and alleviate the fear of running out of money or outliving financial resources. Whether you are. Regardless of how much you borrow from the reverse mortgage or how much equity you have available, you cannot be forced out of your house unless you fall behind. No one can outlive a reverse mortgage. If at least one homeowner lives in the home (keeping taxes and insurance current) there's no need to repay the loan. Reverse mortgages, specifically HECMs, allow homeowners aged 62 and older to utilize a percentage of their home's value to pay off existing mortgages and. A modified tenure reverse mortgage can help to solve this problem by splitting proceeds between monthly payments and a flexible line of credit. A reverse mortgage is a loan available to homeowners aged 62 or older, allowing them to convert a portion of their home's equity into cash. You need to be a homeowner that is 62 or older. · Your home must be your primary residence. · You need to own your home or have small balance on your mortgage. Absolutely. Just be sure that the mortgage doesn't outlive you, so you've got a roof over your head until you are indeed dead. Reverse mortgages aren't risk-free. They can affect your estate and heirs, and there's the scary thought of outliving your loan money. Yikes! But don't panic;. There are risks with outliving the proceeds of a reverse mortgage, especially with today's health system and mortality rates. People need to think about how to. If there is equity in the house (and reverse mortgages stop payments in order to leave some equity there), then you sell the house, and cash the. It allows you to access up to 55% of your home's value without the requirement to make regular mortgage payments. Instead of monthly payments, the loan balance. How Can a Senior Use a HECM Reverse Mortgage to Avoid Outliving Her Money? Are No-Closing-Cost-Reverse Mortgages Available, and Where Do You Go to Find One? HECM Reverse Mortgages have a maximum lending limit of $, This does not mean you will get $, Use the free reverse mortgage calculator to see. Outliving Reverse Mortgages A reverse mortgage cannot be outlived. As long as at least one homeowner lives in the home (keeping taxes and insurance current). Generally speaking, a reverse mortgage loan cannot be outlived and will not become due, as long as at least one homeowner lives in the home as their primary. If you take out a loan with us and have a change of heart, Heartland's 30 day cooling off period allows you to cancel your reverse mortgage within 30 days of. ▫ Higher risk for younger borrowers of outliving their loan funds. *See How can a reverse mortgage affect the people living with me? (continued). Longevity risk. If you outlive your reverse mortgage proceeds, you may face financial challenges in later years. Therefore, it's essential to have a. When it comes to Reverse Mortgage, the offerings of old have evolved toward what's provided anew via the Home Equity Conversion Mortgage—also known as HECM.

Calculate Car Loan Payment Formula

Let's say you have your eye on a compact car or SUV. Choose the make and model you want, or alternatively enter the vehicle's price into the auto loan. A monthly car payment calculator takes your loan details and turns them into projected monthly payments. Your monthly payment will be determined by the vehicle. To calculate auto loan payments, start by finding the monthly interest rate by dividing the annual interest rate by Auto Loan Principal ; Loan Term, 60 Months ; Interest Rate, % ; Monthly Payment, $ ; Total Cost of Car Loan, $27, Biweekly payments. Biweekly savings are achieved by simply paying half of your monthly auto loan payment every two weeks and making times your monthly auto. The average car price people finance: $35, for a new car and $22, for a used car; The average interest rate lenders charge: % for a new car loan and. Our auto loan calculator will provide detailed cost estimates for any proposed car loan. Find the monthly payment, total cost, total interest and more! Use this calculator to help you determine your monthly car loan payment or your car purchase price. Estimate your monthly payments with psm-tyumen.ru's car loan calculator and see how factors like loan term, down payment and interest rate affect payments. Let's say you have your eye on a compact car or SUV. Choose the make and model you want, or alternatively enter the vehicle's price into the auto loan. A monthly car payment calculator takes your loan details and turns them into projected monthly payments. Your monthly payment will be determined by the vehicle. To calculate auto loan payments, start by finding the monthly interest rate by dividing the annual interest rate by Auto Loan Principal ; Loan Term, 60 Months ; Interest Rate, % ; Monthly Payment, $ ; Total Cost of Car Loan, $27, Biweekly payments. Biweekly savings are achieved by simply paying half of your monthly auto loan payment every two weeks and making times your monthly auto. The average car price people finance: $35, for a new car and $22, for a used car; The average interest rate lenders charge: % for a new car loan and. Our auto loan calculator will provide detailed cost estimates for any proposed car loan. Find the monthly payment, total cost, total interest and more! Use this calculator to help you determine your monthly car loan payment or your car purchase price. Estimate your monthly payments with psm-tyumen.ru's car loan calculator and see how factors like loan term, down payment and interest rate affect payments.

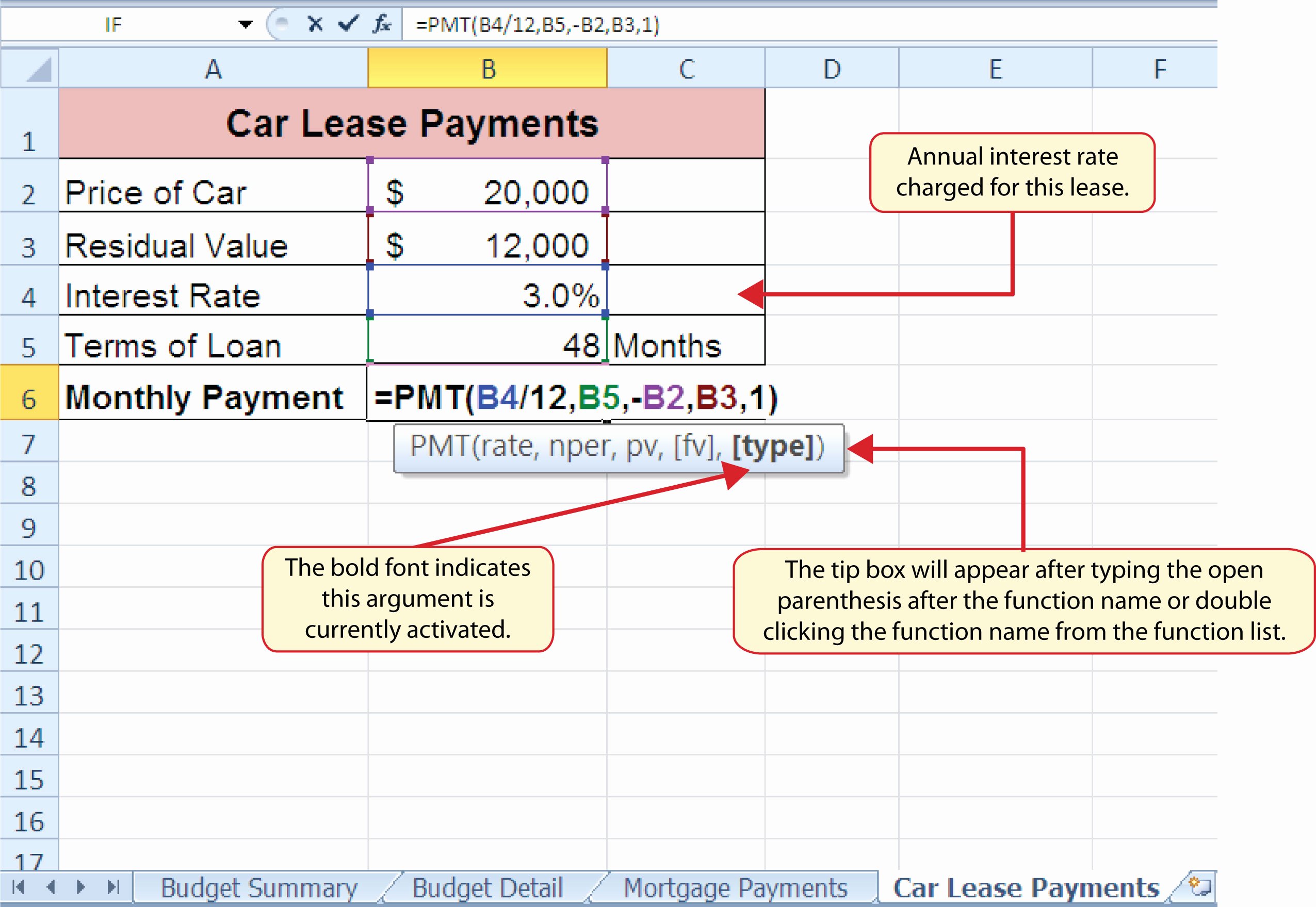

Determine the principal amount borrowed and total interest paid over the life of the loan. · Add any additional fees or charges associated with obtaining credit. Determine the principal amount borrowed and total interest paid over the life of the loan. · Add any additional fees or charges associated with obtaining credit. Here's the formula: $3, x = $1, - $ = $ In other words, you may get pre-approved for a monthly car loan payment up to $ based on this. In simpler terms, the formula for the new monthly payment is: principal x (interest rate / 12). How much would my monthly payment be if I bought a car that. It's total loan amount (including interest) divided by the loan term (number of months you have to repay the loan. For example, the total interest for a $30, The size of your monthly payment depends on loan amount, loan term and interest rate. Loan amount equals vehicle purchase price minus the down payment, net. You will divide the interest rate by 12 for the number of monthly payments in a year. Next, you take that answer and multiply it by the balance of your loan. Divide your interest rate by the number of monthly payments per year. · Multiply the monthly payment by the balance of your loan. · The amount you calculate is. Calculate Your Payments ; Loan Term ·: ; Payment Frequency: ; Your Auto Loan Results ; Payment Amount: ; Loan Amount. What Is the Formula for Calculating Monthly Car Loan Payments? · P = the principal amount · i = the interest rate per month, which equals the annual interest rate. Deferred Payment Loan: Single lump sum paid at loan maturity Use this calculator for basic calculations of common loan types such as mortgages, auto. Use Carvana's auto loan calculator to estimate your monthly payments. See how interest rate, down payment & loan term will impact your monthly payments. Divide the total interest by the number of months in your loan term to find the monthly interest. Example: Here's how to calculate the interest on a car loan if. How to Calculate Interest-Only Loan Payments · Divide your interest rate by the number of payments in a year (12) to get your monthly interest rate: ÷ Equation and Calculator will determine the monthly payments based on interest, down payment, total loan amount. 1. Understand the Loan Variables · 2. Determine the Principal Amount · 3. Know the Loan Term · 4. Calculate Monthly Interest Rate · 5. Use the Amortization Formula. Total interest payment = Loan amount (outstanding balance) x (interest rate / number of payments per year) · Outstanding balance = principal – (repayment –. Monthly payment and annual percentage rate (APR) will vary based on the term, amount financed, model year, loan-to-value (LTV) percentage, credit history and. The car payment formula is M=LX. The monthly payment (M) equals the loan amount (L) times the APR and term factor (X) in a car payment.

How Do I Get Hgtv To Remodel My House

Fixer Upper furniture is just staging, the owners don't get to keep except for pieces made specially for that house. They do have an option to. Watch Air Concierge co-founders Ryan and Claire Danz host HGTV's newest hit show, My House is Your House. The couple helps homeowners transform their home. HGTV is looking for current and soon-to-be homeowners in the Hudson Valley area who are looking to renovate their home. Design Your Dream Home with Help from HGTV, the No. 1 home improvement television network. Take a fresh approach to the way you live, including building a. Houses | HGTV's Rehab Addict. Welcome to My World of Old Houses. Old People. Old Dogs.™. Nothing more empowering than standing right in the middle of Woodward. Remodeling a house isn't easy, especially if it's the one you grew up Easily one of the best designers on HGTV, my opinion. 4 hrs. 4. Kim Lowe. Rose. Want to be a part of an HGTV renovation? HGTV has a website where casting calls are posted. However, if you don't see an opening. Homeowners must have an existing renovation budget of at least $K that will be utilized by our design team;; Renovations will focus on major spaces in. HGTV is casting RIGHT NOW for homeowners ready to transform a room in their house, giving it a fresh new look, by getting professional help from one of the. Fixer Upper furniture is just staging, the owners don't get to keep except for pieces made specially for that house. They do have an option to. Watch Air Concierge co-founders Ryan and Claire Danz host HGTV's newest hit show, My House is Your House. The couple helps homeowners transform their home. HGTV is looking for current and soon-to-be homeowners in the Hudson Valley area who are looking to renovate their home. Design Your Dream Home with Help from HGTV, the No. 1 home improvement television network. Take a fresh approach to the way you live, including building a. Houses | HGTV's Rehab Addict. Welcome to My World of Old Houses. Old People. Old Dogs.™. Nothing more empowering than standing right in the middle of Woodward. Remodeling a house isn't easy, especially if it's the one you grew up Easily one of the best designers on HGTV, my opinion. 4 hrs. 4. Kim Lowe. Rose. Want to be a part of an HGTV renovation? HGTV has a website where casting calls are posted. However, if you don't see an opening. Homeowners must have an existing renovation budget of at least $K that will be utilized by our design team;; Renovations will focus on major spaces in. HGTV is casting RIGHT NOW for homeowners ready to transform a room in their house, giving it a fresh new look, by getting professional help from one of the.

Step 1: See Which Shows Are Casting · Step 2: Select a House Makeover Show · Step 3: Apply for a Home Makeover · Step 4: Provide Photos of Potential Makeover Rooms. Photos or listing link of the house you're considering fixing up · A family photo · Describe your original wishlist · Describe what you will need to renovate in. My First Renovation (–12); My House, Your Money (–12); Weekends "Charlotte townhome to be featured on HGTV's 'My Lottery Dream Home". WCNC. Fixer-uppers are on the wish lists of house hunters in this addition to HGTV's long-running franchise. In each episode, the featured home buyers tour three. Let HGTV help you transform your home with pictures and inspiration for interior design, home decor, landscape design, remodeling and entertaining ideas. The experts at HGTV bring you the latest trends and updates in the home industry and tell you why it matters. Create the room you've always wanted with our. I'm Lyndsay Lamb, the twin with bangs! I love using my creativity to help find exactly the thing they're looking for—then celebrate with them when they do! So, my wife and I are watching yet another catastrophic issue on an HGTV show that blows the new homeowners budget. The designers come up with these. HGTV News · Retta Returns in a Spine-Tingling 'Ugliest House' Spinoff: 'Scariest House In America' Aug 28, · Jasmine Roth Talks Shop, Motherhood and Moving. In HGTV's Generation Renovation: Lake House, renovator and designer Danielle Bryk builds a new family cottage for her toughest clients yet—her sister and. Designer Meg Caswell, host of HGTV's hot series Meg's Great Rooms, and master carpenter Marc Bartolomeo are teaming up to give one lucky family a complete. I Wrecked My House · Home Town · Home Town Takeover · Married to Real Estate · My HGTV Now Casting for a New Orange County, CA Home Renovation Show. We're. You can submit your house in need of a renovation to appear on an upcoming season of This Old House. From downtown lofts, to ornate country Victorians, to. Jasmine Roth works with homeowners to fix their DIY disasters and transform their spaces in HGTV's Help! I Wrecked My House. All About Jasmine. The Latest. The TV personality (show hosts are not real renovation professionals who remodel homes when not on TV) will tell the homeowners something like “I'm so sorry. Homebuyers tour potential homes to renovate and decorate. Link your TV provider to watch House Hunters Renovation free with your pay TV subscription. In full transparency, we hadn't planned to renovate our house on the show. Lisa grew up coming to visit NWA with her [ ] Read more. Lakeside Home Reno. I want to share an exciting recap of the Dream House, a bathroom renovation project at my own home and a Delta Faucet giveaway for you! Stream HGTV Building & Renovation shows or find something new to watch on discovery+. Stream HGTV shows on Max. Sign up to watch series on home design, decorating and remodeling, landscaping, and more. Plans start at $/month.

Boost Customer Support

When you have any technical issues or other concerns that you prefer to receive support via email, you can contact us at [email protected] and our. Accessibility StatementIf you are using a screen reader and having difficulty with this website, please call –– Financial Products & Services Privacy. Got questions? Find answers below or reach out to us. We are here to serve you better. Sign in · Top FAQs · New To Boost · Manage Boost Account. GENERAL INQUIRIES Or, call us Toll Free at PAYMENT INQUIRIES. [email protected] Or, call us Toll Free. Need some tips on how to motivate employees as a support manager? Here are seven strategies you can use to help your team work at their full potential. Boost app, Boost infinite, and website. Your customer service confirms both lines are in service, but has no idea why I can no longer. Unfortunately Boost does not have a Hotline number that you can call however, rest assured that help can be found in the articles in the "FAQ" section. Boost your self-service rates and reach new heights of customer satisfaction using our end-to-end conversational AI platform! Telephone Email [email protected] Chat, Open a Support Ticket, Download Boost Elevate POS and Review POS Knowledge Base. When you have any technical issues or other concerns that you prefer to receive support via email, you can contact us at [email protected] and our. Accessibility StatementIf you are using a screen reader and having difficulty with this website, please call –– Financial Products & Services Privacy. Got questions? Find answers below or reach out to us. We are here to serve you better. Sign in · Top FAQs · New To Boost · Manage Boost Account. GENERAL INQUIRIES Or, call us Toll Free at PAYMENT INQUIRIES. [email protected] Or, call us Toll Free. Need some tips on how to motivate employees as a support manager? Here are seven strategies you can use to help your team work at their full potential. Boost app, Boost infinite, and website. Your customer service confirms both lines are in service, but has no idea why I can no longer. Unfortunately Boost does not have a Hotline number that you can call however, rest assured that help can be found in the articles in the "FAQ" section. Boost your self-service rates and reach new heights of customer satisfaction using our end-to-end conversational AI platform! Telephone Email [email protected] Chat, Open a Support Ticket, Download Boost Elevate POS and Review POS Knowledge Base.

If you have questions, we'd love to talk with you. Email us at [email protected], or call us at () You can also use this form. Contact Us · Chat. Let us know if you have any questions - we'll respond within 24 business hours if we are not currently online. · Customer Support. 45 reviews and 8 photos of BOOST MOBILE "I called the boost mobile customer support line yesterday and I had a HORRIBLE experience. Please find below our customer service policies. If you have any questions or concerns, we invite you contact us at: [email protected], at any time. To talk to a real person at Boost Mobile, call (BOOST) Monday through Friday between 4 am and 8 pm PT, and on weekends between 4 am and 7 pm PT. Boost customer loyalty and customer lifetime value (CLV) with voice of the customer (VOC), proactive outreach, and self-service options – Analyze. customer it try's to sell me sim for and unlimited data talk text then App Support · Privacy Policy. Supports. Wallet. Get all of your passes. Check out our B2B payment services and why you should choose Boost. We serve AP, AR, issuers and fintech partners. Contact Us and leave us a message. The dedicated winter support package is open from 30 October. It's there to give financial and practical support to eligible customers. We Want to Hear from You · Got Questions? You can look through our FAQ page · RINGBOOST. · The Boost Mobile customer service number is Users can use this number to speak with a customer service representative to assist them with. Contact Boost Oxygen at to get in touch with our excellent customer service reps. Got a question about oxygen to go? Help is Here! Monday to Friday, 8am to 6pm or Saturday, 9am to 2pm. Contact Us. We Want to Hear from You · Got Questions? You can look through our FAQ page · RINGBOOST. · Boost Mobile offers a dedicated customer service phone number to address your concerns quickly. To speak with a live representative, call BOOST ( How to contact Boost Mobile Australia customer support at general info phone number? Call or write an email to resolve Boost Mobile Australia issues. Can't find related issue? Let us help you! Send us a request and will get back to you soon. Alternatively, drop us an email to our customer service at support@. In the event that delivery with Canada Post is not available due to a work stoppage or strike, Boost will ship all orders via Federal Express. In continental. The dedicated winter support package is open from 30 October. It's there to give financial and practical support to eligible customers. Boost Mobile offers a dedicated customer service phone number to address your concerns quickly. To speak with a live representative, call BOOST (